Informed issuers obtain the best results

With the exception of crisis-induced regulatory change and occasional product innovation, the basic architecture of capital markets financing in the US has gone largely unaltered for decades. The process involves companies, which infrequently access the financial markets, retaining Wall Street banks, which execute such transactions as a primary business, and possess extensive deal experience, product expertise and highly-valued relationships with investors as a result, to manage their securities offerings and other capital structure initiatives.

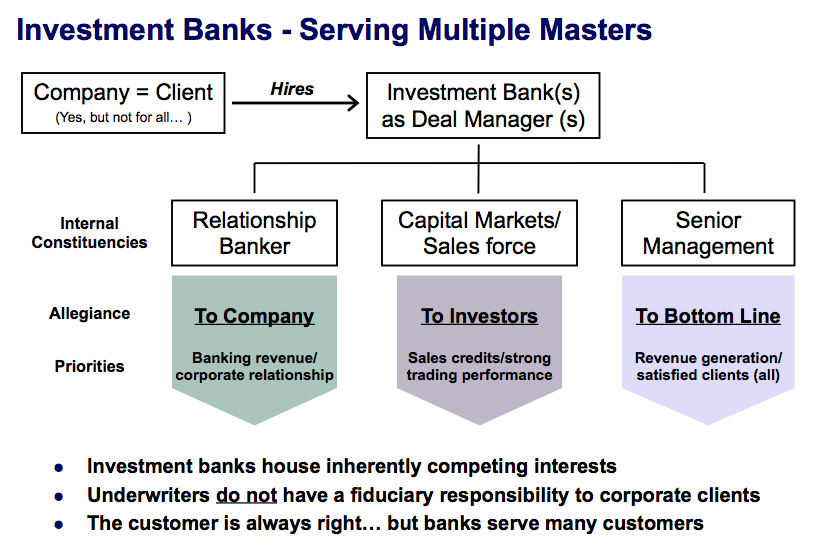

This “toll-booth” model has proven highly lucrative for investment banks, which charge substantial fees to raise capital and consistently rank among the most profitable US businesses, but has long suffered from a material weakness. In serving the interests of clients on both sides of financing transactions – corporations as “issuers” of securities and investors as “buyers” – banks play a role that is inherently and fundamentally conflicted.

Further compounding this is the fact institutional investors are typically far larger and more consistent clients of the investment banks than any single corporate issuer. The conflict also requires the banks to secure expansive indemnification from issuers against any perceived legal or fiduciary obligations, as well as any potential claims of reliance upon them regarding terms, risks or conditions of the financing. (The latter is particularly ironic given that it is often a bank’s specific expertise with a financial product or structure that secures its mandate in the first place.)

Further compounding this is the fact institutional investors are typically far larger and more consistent clients of the investment banks than any single corporate issuer. The conflict also requires the banks to secure expansive indemnification from issuers against any perceived legal or fiduciary obligations, as well as any potential claims of reliance upon them regarding terms, risks or conditions of the financing. (The latter is particularly ironic given that it is often a bank’s specific expertise with a financial product or structure that secures its mandate in the first place.)

Recognizing the weakness in this construct and disadvantaged position in which it places companies gives rise to an important question – How might issuers close the know

ledge and experience gap between them and their deal manager(s) and counter any potentially unfavorable impacts of the banks’ conflicted position to meet their obligations to shareholders.

At Aequitas, we believe it is incumbent upon officers and directors to approach securities offerings from an informed, engaged perspective. We put our decades of product expertise and bank-side sales/trading and deal structuring/execution experience to work on behalf of corporate clients to close this experience “gap”, preserve leverage and secure superior outcomes.

Members of Aequitas Advisors LLC are registered with Zanbato Securities LLC. Securities products and services offered by Zanbato Securities LLC, member of FINRA and SIPC, and Zanbato UK, Ltd, member of FCA (together “Zanbato Securities”). Zanbato Securities LLC and Zanbato UK, Ltd are wholly-owned subsidiaries of Zanbato, Inc., which designs and develops software for private placement professionals. Zanbato Securities has no relationship with any entities mentioned outside of the Zanbato family of companies. Check the background of Zanbato Securities LLC on FINRA’s BrokerCheck. Neither the information nor any views expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment or any options, futures or derivatives related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person who may receive this material.

CONTACT

Aequitas Advisors LLC.

1266 East Main Street, 4th Flr

Stamford, Ct. 06902

Phone:

203-352-2711

203-352-2710

Email:

[email protected]